Overview

Best practices for secure file transfer links in accounting are essential for enhancing compliance and operational efficiency. By implementing measures such as:

- Encryption

- Access controls

- Automated workflows

organizations can significantly mitigate the risks associated with cyber threats. These practices not only safeguard sensitive financial information but also streamline communication and improve response times. Consequently, this leads to greater productivity in accounting processes. Embracing these strategies is not just a recommendation; it is a necessity for accounting managers who aim to protect their data while optimizing their operations.

Introduction

In the accounting realm, where sensitive financial data is handled daily, the importance of secure file transfer cannot be overstated. With cyber threats looming large, the stakes are higher than ever, as evidenced by alarming statistics revealing that the finance sector was the most breached industry in 2023.

As accountants juggle personal information, tax returns, and proprietary data, the need for robust security measures becomes paramount. This article delves into the critical role of secure file transfer systems, exploring:

- Best practices

- Compliance regulations

- Technological advancements

These elements not only protect sensitive information but also enhance operational efficiency and client engagement. By embracing secure file transfer solutions, accounting professionals can navigate the complexities of modern data management while safeguarding their firms against the ever-evolving landscape of cyber risks.

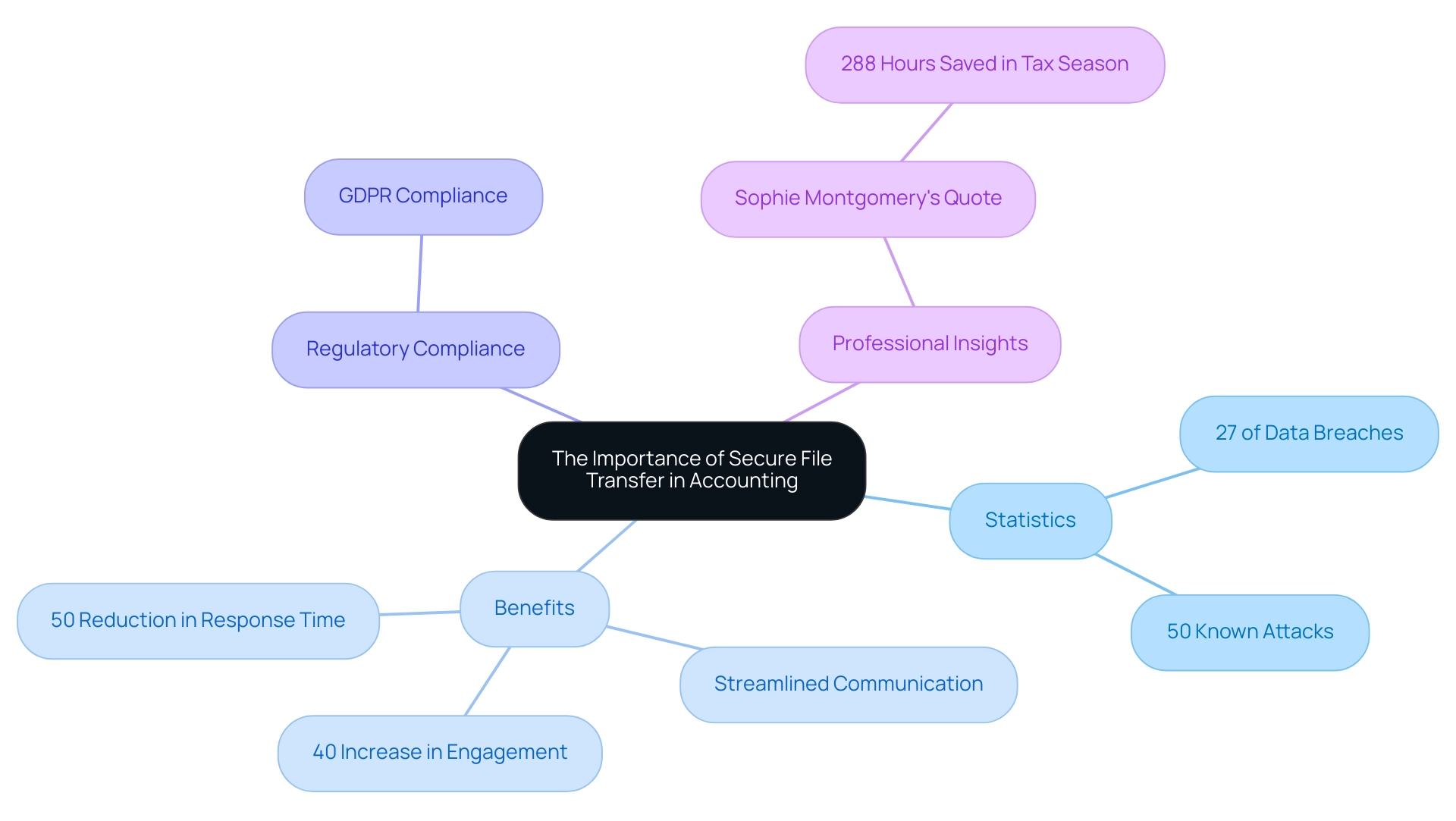

The Importance of Secure File Transfer in Accounting

In the accounting sector, the significance of a secure file transfer link for safe document exchange is paramount, particularly given the sensitive nature of financial information managed daily. Accountants oversee personal information, tax returns, and proprietary firm data, rendering them prime targets for cyber threats. Recent statistics reveal that in 2023, the finance sector was the most breached industry, accounting for 27% of all data breaches, with large financial organisations experiencing an average of 50 known attacks.

This reality underscores the urgent need for robust security measures. Glasscubes offers a secure file exchange system featuring a secure file transfer link, protecting this vital information while ensuring compliance with regulations such as GDPR. Its capabilities include:

- A well-structured list that clearly outlines pending items and queries, facilitating quick resolution and instilling confidence in your firm.

This system reduces response time for customer information by 50%, increases responses to requests by 40%, and enhances overall engagement, making interactions as straightforward and convenient as email, while overcoming challenges such as lack of security and organisation. Moreover, a secure file transfer link boosts operational efficiency by streamlining communication processes, allowing accountants to focus on their primary responsibilities without the constant concern of data safety. As Sophie Montgomery from TaxAssist Accountants remarked, implementing effective systems can lead to substantial time savings, enhancing overall productivity during peak periods like tax season.

This efficiency is crucial, especially as the landscape of cyber threats evolves, with projections indicating that 15% of all data breaches in 2024 will involve a supply chain compromise. Ultimately, reliable document exchange serves as a fundamental component of contemporary accounting practices, reinforcing both compliance and operational efficiency while providing assurance for your firm and clients.

Best Practices for Creating Secure File Transfer Links

To establish secure document transfer links within accounting processes, professionals must adhere to best practices that enhance security and efficiency:

-

Utilise Encryption: Always encrypt documents prior to sharing. This crucial step safeguards sensitive information, ensuring that if a document is intercepted, it remains inaccessible without the proper decryption key. Recent statistics underscore the importance of encryption in the face of evolving cybersecurity threats, with projections indicating that cyber attacks could cost over $10.5 trillion by 2025. The emergence of 5G and 6G technologies further introduces new security risks, highlighting the necessity for robust encryption measures. Glasscubes facilitates this by enabling users to encrypt documents before sharing them through the platform.

-

Set Expiration Dates: Implement links that automatically expire after a designated timeframe. This practice minimises prolonged access to sensitive data and reduces the chances of unauthorized retrieval. Glasscubes offers the ability to set expiration dates on shared links, significantly enhancing security.

-

Implement Access Controls: Enforce strict access controls based on user roles. This measure ensures that only authorised individuals can view or download confidential documents, greatly enhancing security. Glasscubes provides customisable access controls, allowing users to determine who has access to specific documents.

-

Utilise Unique Links: Create distinct links for each document shipment instead of reusing them. This approach mitigates the risk of unauthorized access by ensuring that links are tied to specific transactions. Glasscubes automatically generates unique links for each transfer, reinforcing security.

-

Monitor Access Logs: Regularly review access logs to track who has accessed documents and when. This practice enables prompt detection of any suspicious activities, ensuring that potential breaches are addressed swiftly. Glasscubes includes monitoring features that allow users to easily review access logs.

-

Consider SFTP Solutions: As Robert Dougherty notes, ‘SFTP provides a reliable and secure solution for transferring data between systems.’ It guarantees that sensitive information remains secure during the transfer process. Accountants can enhance the security of their document transfers, ensuring adherence to industry standards while fostering efficiency in collaboration with customers. Notably, utilising platforms like Glasscubes not only simplifies the onboarding process—requiring no training and tailored support during initial setup—but also leads to a 50% reduction in client response times and increased engagement through automated communication tools. This illustrates how Glasscubes can greatly simplify accounting processes while ensuring protected document sharing.

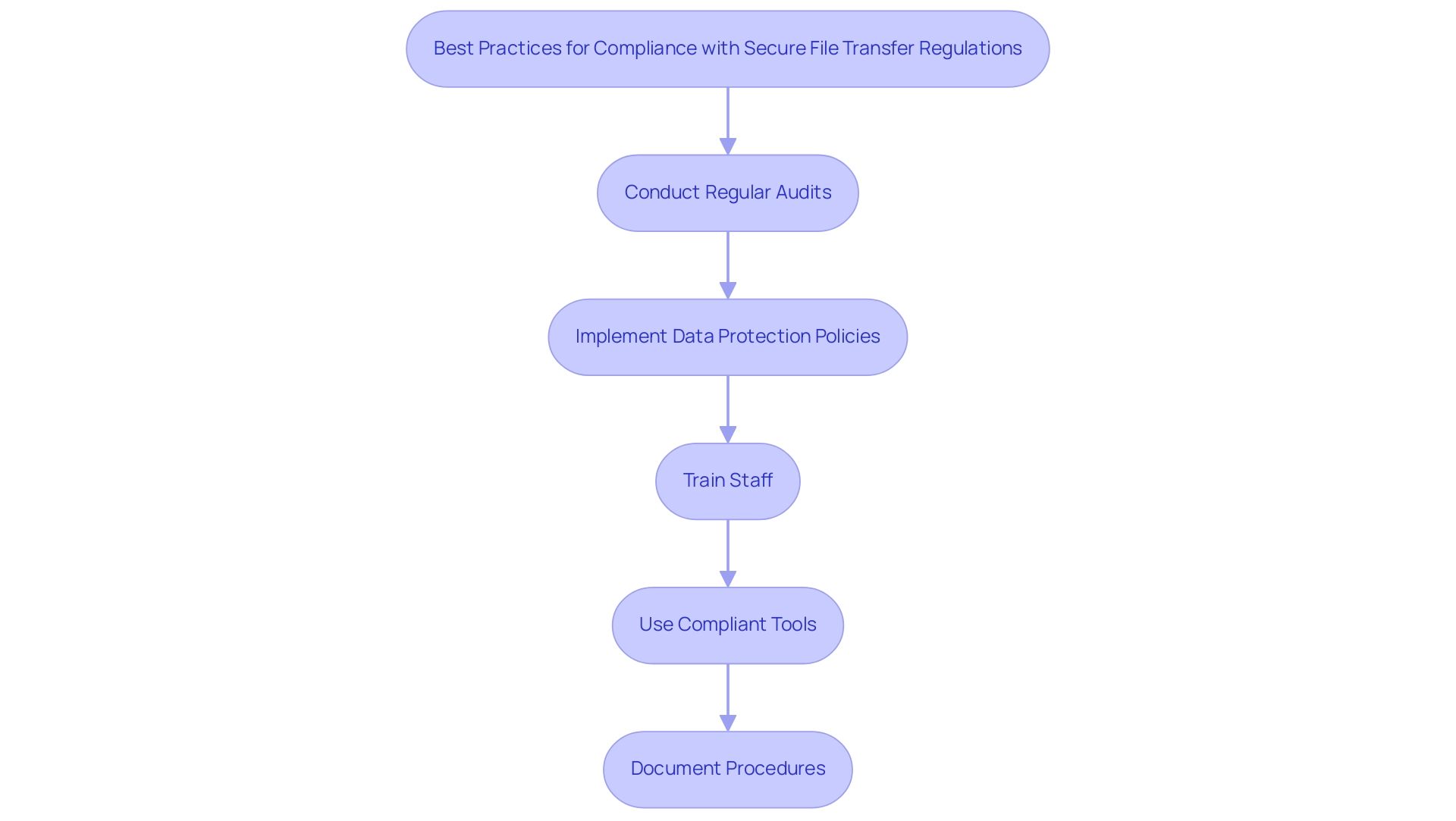

Ensuring Compliance with Secure File Transfer Regulations

Complying with safe document exchange regulations is essential for accounting firms, particularly in light of stringent requirements such as GDPR, which safeguards personal information, and HIPAA, which governs health data management. As Saravanan noted, ‘Two-thirds of corporate risk and compliance professionals agree that their organisation has a duty to stakeholders and society to address ESG-related issues.’ To uphold compliance, firms must adopt best practices regarding secure file transfer links.

- Conduct Regular Audits: Frequent evaluations of document exchange procedures are crucial to ensure alignment with regulatory standards.

- Implement Data Protection Policies: Establish and enforce comprehensive policies that detail the handling and sharing of sensitive data.

- Train Staff: Ensure that all employees receive thorough training on compliance obligations and secure document sharing protocols.

- Use Compliant Tools: Select data exchange solutions specifically designed for compliance, featuring encryption and robust access controls.

- Document Procedures: Maintain meticulous records of document movement processes to demonstrate compliance during audits.

With 53% of businesses leaving sensitive data accessible to unauthorized employees, it is imperative that accounting firms actively implement these measures to mitigate risks and enhance their security posture in 2025. Furthermore, with 61% of respondents anticipating an increase in the cost of senior compliance officers, the financial implications of compliance cannot be overlooked. A case study on Secureframe illustrates the benefits of compliance automation, where 97% of users reported an improved security stance, emphasizing the effectiveness of implementing best practices in safe data exchange.

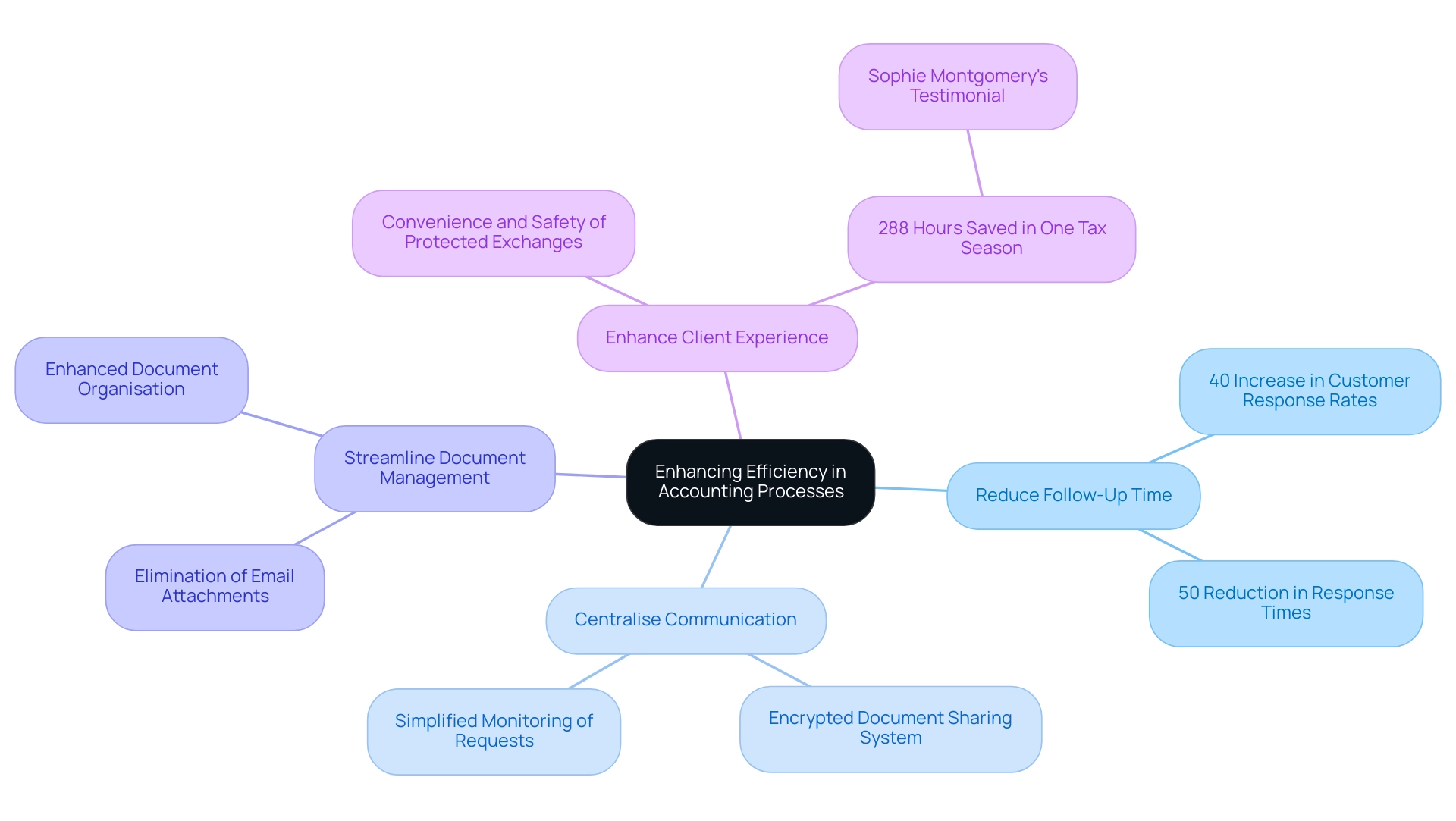

Enhancing Efficiency in Accounting Processes with Secure Transfers

A secure file transfer link is crucial for enhancing efficiency in accounting processes. By adopting secure platforms like Glasscubes, accountants can:

-

Reduce Follow-Up Time: Automated reminders and notifications serve as effective prompts for customers, significantly minimising the time spent chasing information.

Firms utilising Glasscubes have reported a remarkable 40% increase in customer response rates, leading to a 50% reduction in response times.

-

Centralise Communication: An encrypted document sharing system integrates all customer interactions, simplifying the monitoring of requests and responses without the confusion of separate email threads.

-

Streamline Document Management: The reliance on cumbersome email attachments is eliminated, simplifying document organisation and retrieval, which in turn enhances overall workflow.

-

Enhance Client Experience: Customers benefit from the convenience and safety of protected document exchanges, boosting satisfaction levels and retention rates. For instance, Sophie Montgomery from TaxAssist Accountants emphasised the efficiency gains, reporting an impressive 288 hours saved in just one tax season.

Facilitating remote work, secure file transfer links empower accountants to operate effectively from any location, ensuring that communication remains seamless and secure. This adaptability is essential in today’s dynamic work environment, aiding accounting firms in addressing the changing requirements of those they serve while maintaining compliance and efficiency. Additionally, the user-friendly interface of Glasscubes, which requires no training, significantly contributes to enhancing efficiency and customer satisfaction.

The dedicated onboarding assistance provided by Glasscubes further enhances user engagement strategies, ensuring that firms can maximise the benefits of these tools. Discover how we transform client engagements in just 4 minutes! Watch our on-demand demo to see how we streamline information gathering and avoid workload bottlenecks.

Where should we send the link? Join firms like Menzies that have experienced these improvements and, if you prefer a tailored experience, click here to schedule a personalised demo with one of our Product Specialists.

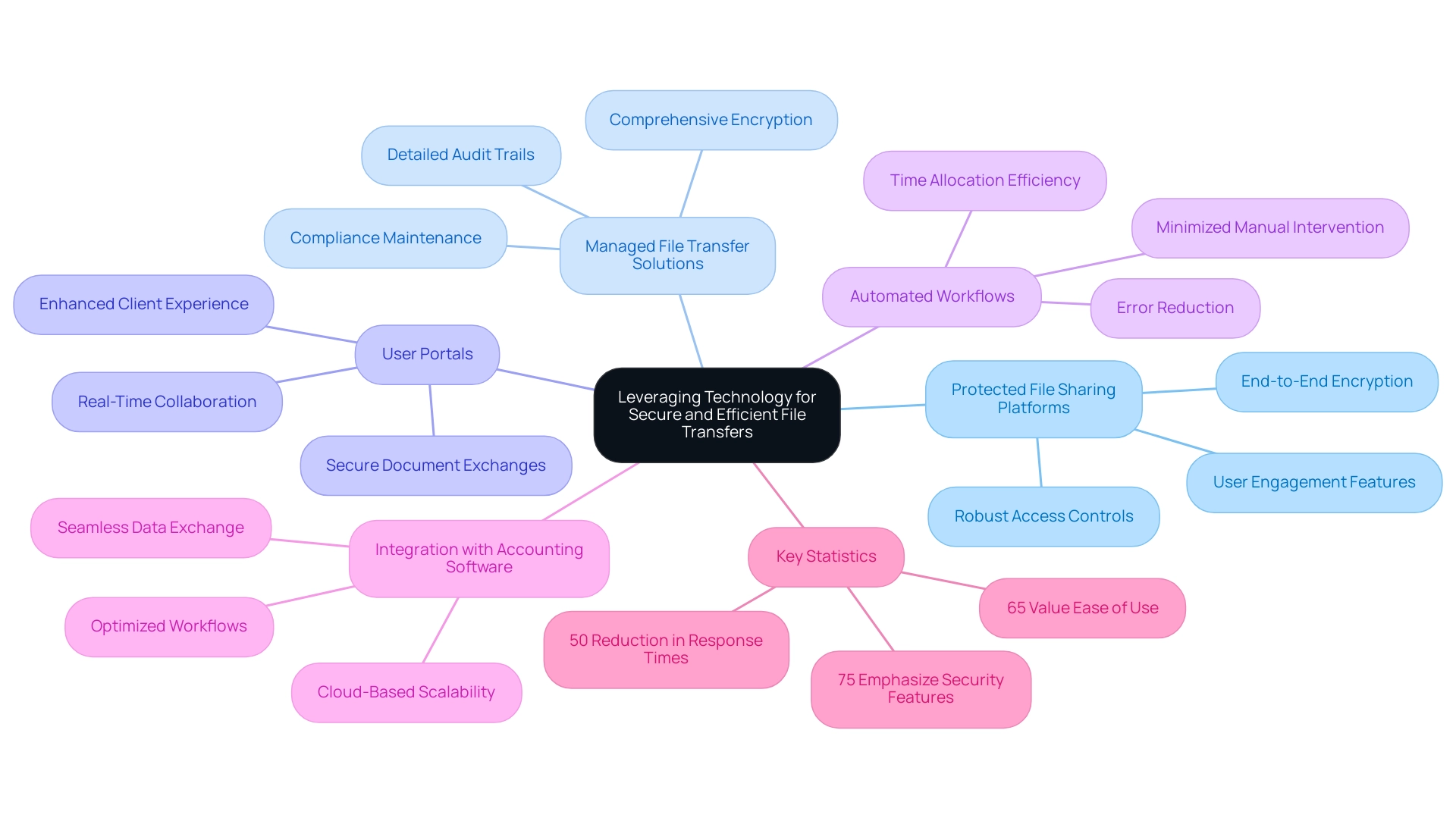

Leveraging Technology for Secure and Efficient File Transfers

To effectively leverage technology for secure and efficient document transfers, accountants must consider several essential tools:

- Protected File Sharing Platforms: Opt for platforms such as Glasscubes that provide a secure file transfer link, ensuring safe file sharing through features like end-to-end encryption and robust access controls to safeguard sensitive information. The user-friendly interface and automated reminders of the platform significantly enhance user engagement while ensuring compliance.

- Managed File Transfer (MFT) Solutions: Implement MFT solutions that guarantee a secure file transfer link, offering comprehensive end-to-end encryption and detailed audit trails—crucial for maintaining compliance and security in financial processes. These solutions are increasingly favoured as firms acknowledge their importance in securely handling high-value data.

- User Portals: Utilise user portals that furnish a secure file transfer link for document exchanges and real-time collaboration, thereby enhancing engagement and streamlining workflows. Such portals not only strengthen security but also elevate the overall client experience by providing a secure file transfer link.

- Automated Workflows: Automate document movement processes to minimise manual intervention. This approach reduces the risk of errors and enhances efficiency, enabling accountants to allocate their time more effectively.

- Integration with Accounting Software: Choose data exchange solutions that seamlessly connect with existing accounting software. This integration is vital for optimising workflows and boosting productivity, particularly as organisations increasingly seek cloud-based solutions for scalability and cost-effectiveness.

With 75% of organisations emphasising security features and 65% valuing ease of use, these tools exemplify best practices for secure document exchanges in accounting. Furthermore, the growing demand for cloud-based solutions for safe document sharing, such as a secure file transfer link, signals a market shift towards scalability and cost-effectiveness. As Roman Kepczyk, Director of Firm Technology Strategy for Rightworks, observes, many small to medium firms encounter barriers such as a lack of IT knowledge and the perceived costs associated with adopting new technologies.

By embracing established safe document sharing platforms, like those demonstrated by Biscom Inc.’s enhanced protected data exchange solution, accounting firms can surmount these challenges and improve their operational efficiency. Additionally, while the context of cookie settings and privacy policies may not be directly relevant, it underscores the significance of maintaining privacy and security in all digital interactions, including document sharing.

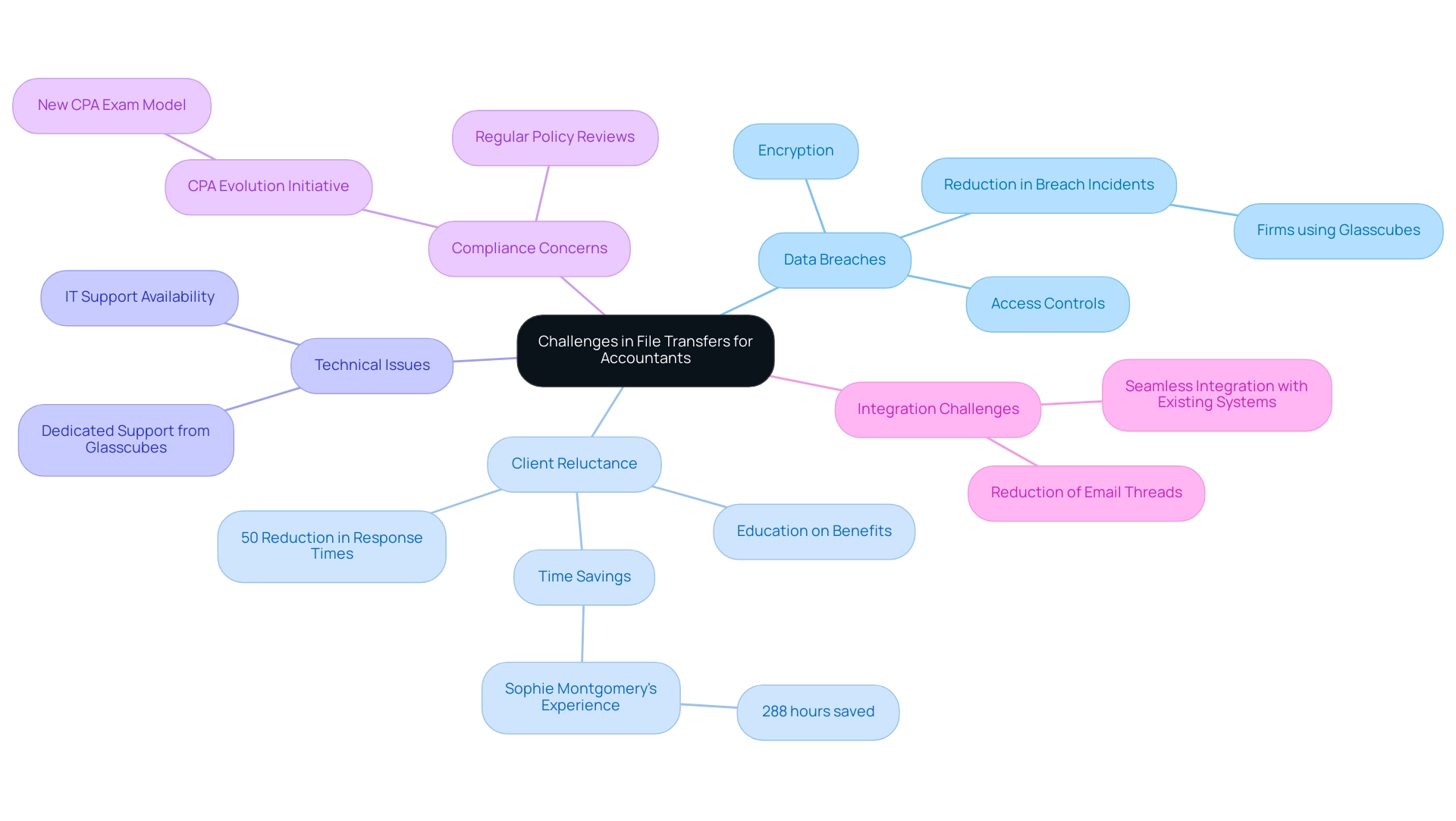

Overcoming Challenges in File Transfers for Accountants

Accountants encounter various obstacles in secure document exchanges that can significantly impact their productivity and compliance. Key challenges include:

-

Data Breaches: The accounting sector has witnessed a notable rise in data breaches, making the implementation of robust encryption and access controls essential for protecting sensitive information. Firms that have embraced advanced security protocols, such as those provided by Glasscubes, report a marked reduction in breach incidents.

-

Client Reluctance: Overcoming client hesitation regarding secure document exchanges is crucial. Educating clients on the benefits—such as enhanced security and streamlined communication—can facilitate their adoption of these practices. For instance, Sophie Montgomery from TaxAssist Accountants shared that she saved an impressive 288 hours in a single tax season through the efficient communication enabled by Glasscubes. This is particularly relevant as companies utilising Glasscubes have experienced a 50% decrease in response times, underscoring the importance of effective communication in secure document exchanges.

-

Technical Issues: It is vital to ensure that IT support is readily available to address any technical difficulties, thereby maintaining a smooth data exchange process. Glasscubes provides dedicated support to resolve technical challenges, ensuring seamless operations.

-

Compliance Concerns: Regular reviews and updates of compliance policies are necessary to align with evolving regulations, especially as the accounting profession adapts to new standards introduced by initiatives such as the CPA Evolution Initiative. Glasscubes assists firms in staying compliant by offering tools that facilitate adherence to these regulations.

-

Integration Challenges: Selecting data exchange solutions that integrate seamlessly with existing systems minimises disruption and enhances efficiency, aiding firms in navigating the complexities of modern accounting practices. Prior to adopting Glasscubes, many accountants contended with lengthy email threads that resulted in lost information and duplicated requests.

By proactively addressing these challenges, accountants can establish a secure file transfer connection with Glasscubes, ultimately fostering greater client trust and engagement.

Conclusion

The importance of secure file transfer in the accounting industry is paramount, particularly in a landscape rife with cyber threats and stringent compliance requirements. By adopting best practices such as:

- Encryption

- Access controls

- Automated workflows

accountants can effectively protect sensitive financial data while simultaneously enhancing operational efficiency. Statistics underscore an urgent need for robust security measures, with the finance sector identified as the most breached industry in 2023.

Furthermore, integrating secure file transfer solutions not only guarantees compliance with regulations such as GDPR and HIPAA but also cultivates improved client engagement and satisfaction. Platforms like Glasscubes exemplify how technology can facilitate secure document exchanges while streamlining communication processes, ultimately resulting in significant time savings and productivity gains during critical periods, such as tax season.

In summary, investing in secure file transfer systems transcends mere data protection; it empowers accounting professionals to concentrate on their core responsibilities without the incessant concern of security breaches. As the accounting industry evolves, prioritising secure file transfers will be essential in navigating the complexities of modern data management, bolstering client trust, and achieving operational excellence. Embracing these solutions today will lay the groundwork for a more secure and efficient accounting practice tomorrow.