For accountants, prompt client response times are essential for success and profitability. Clients expect timely communication, and the ability to deliver quick responses on your end can significantly impact client satisfaction and contribute to business growth.

Personal income tax client response time requires special attention because every accounting firm knows how the hustle and bustle of tax time can overload even the most experienced teams. By implementing the tactics below, you can improve your client response times, ensure exceptional service delivery, and increase your bottom line.

Wishing you could get your clients to respond faster, too? Glasscubes improves communication on both ends. Book a free demo today!

How Improving Client Response Time Impacts Your Firm’s Profits

1. Greater Client Satisfaction

Firstly, prompt and efficient response to client inquiries enhances client satisfaction and loyalty.

When clients receive timely responses, it shows that your firm values their business and cares about their needs. That becomes the foundation for a strong client-firm relationship, which can lead to repeat business and referrals from satisfied clients.

2. Reduced Client Attrition

A quick response time can help prevent client dissatisfaction and potential loss of business. If requests are not addressed promptly, clients may become frustrated and seek out other accounting firms for next tax season.

A swift response time ensures that clients feel heard and their concerns are addressed in a timely manner, reducing the risk of losing clients to competitors.

3. Positive Brand Reputation

Client response time can also influence your firm’s reputation and brand image.

In today’s digital age, clients have high expectations for quick and efficient communication. Accounting firms that consistently provide timely responses are more likely to be perceived as professional, reliable, and trustworthy, which can attract new clients and contribute to your firm’s profitability.

4. Improved Cash Flow

Timely responses to client inquiries can help expedite the completion of accounting tasks, such as invoice generation, financial reporting, and tax filing.

This can result in faster payment cycles, reducing accounts receivable turnover and improving the firm’s cash flow. Faster cash flow can positively impact the firm’s profitability by providing access to funds for business operations, investments, and growth.

5. Increased Productivity

Quick response time enables effective communication and collaboration between the accounting firm and its clients. By promptly addressing client queries, providing necessary documentation, and resolving issues, your firm can ensure that clients have all the information they need to move forward with their financial plans.

Such efficient client interaction saves time for both your firm and your clients, allowing your accounting team to focus on other tasks and serve a larger client base. Enhanced productivity translates into more billable hours and increased revenue for the firm.

8 Ways To Reduce Personal Income Tax Client Response Time

So, all of the above sounds great, but… how do you actually go about improving your client response times? Below are a few methods with examples from a few anonymous accountants.

1. Set clear response expectations.

During the initial consultation, you can provide clients with a clear understanding of what to expect in terms of response times for various types of inquiries. This helps manage client expectations and reduces frustration.

You may establish response time standards based on, say, urgency or complexity to ensure consistent service. These standards can be communicated to clients through a service level agreement or via email.

![]() Example:

Example:

“In our onboarding process, we set clear expectations with our clients regarding response times. We inform them that:

- Urgent matters, such as urgent tax filing requests or time-sensitive financial advice, receive a response within 24 hours.

- Moderately urgent inquiries, like clarification on financial statements, receive a response within 48 hours.

- General inquiries, such as routine questions about invoices, are addressed within 72 hours.

“By categorizing inquiries, we can allocate our resources effectively and ensure timely responses.”

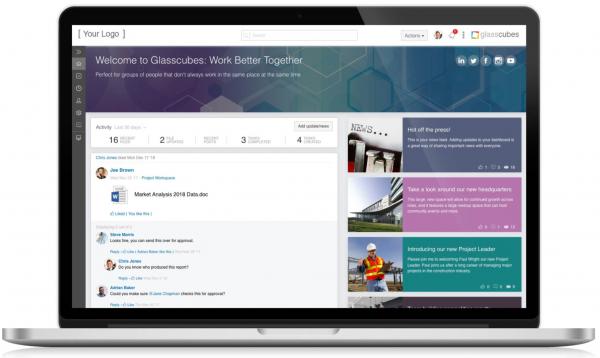

2. Leverage collaboration tools.

Using a centralized client portal, you can provide clients with secure access to upload documents, make inquiries, and receive updates. This eliminates the need for multiple email exchanges and ensures that all communication is organized and easily accessible in one location.

When working with clients on financial statements or other shared documents, your team can use the portal to allow real-time access and input, expediting client response times.

![]() Example:

Example:

“Our accounting firm employs a client portal where clients can securely upload their financial documents, ask questions, track the progress of their projects, and provide direct input on important documents. By streamlining communication through this platform, our clients experience faster response times since our team can efficiently address their queries and provide updates in a centralized location.”

From personal income tax to standard bookkeeping, client portal Glasscubes helps you improve response times and keep all client work in one secure place. Book a free demo today.

3. Prioritize urgent inquiries.

Accountants can implement strategies to quickly identify and prioritize urgent inquiries. You can do this by using specific keywords or tags that signal the urgency of a client request, allowing accountants to address these matters in a timely manner.

![]() Example:

Example:

“To ensure we address urgent client inquiries promptly, we have implemented a system where urgent emails or messages are flagged with specific tags in our communication platform. This allows our team members to quickly identify and prioritize urgent matters, ensuring that clients receive a response within the specified timeframe.”

4. Automate routine tasks.

By leveraging automation tools or software, accountants can reduce response times for repetitive tasks that do not require extensive manual intervention.

![]() Example:

Example:

“We have implemented automation software to streamline repetitive tasks like generating monthly financial reports for our clients. With the click of a button, the system automatically generates the reports, enabling us to provide clients with their financial information faster and allocate more time to address complex financial matters.”

5. Implement email templates.

You can create well-crafted email templates to respond to common inquiries or requests, saving time and improving response times. These templates can be personalized as needed, ensuring a personalized touch while still maintaining efficiency.

![]() Example:

Example:

“To improve our response times for routine client inquiries, we have developed a set of predefined email templates. These templates cover common topics like invoice requests, general tax questions, or document collection reminders. By using these templates, we maintain consistency in our messaging while reducing the time spent on composing individual responses.”

6. Employ chatbots or AI assistants.

Chatbots or AI assistants can be implemented to provide instant responses to routine client inquiries or assist in gathering necessary information, reducing response times and improving overall client satisfaction.

![]() Example:

Example:

“We have deployed a chatbot on our website to help address frequently asked questions from clients. The chatbot provides instant responses to common inquiries, allowing our team to focus on more complex client matters. This technology has significantly reduced response times for these types of inquiries, and clients appreciate the immediate assistance they receive.”

7. Establish regular follow-up processes.

Implementing regular follow-up processes, such as scheduling regular check-ins or setting reminders for pending client queries, ensures that no client requests go unresolved or unanswered for extended periods.

![]() Example:

Example:

“To prevent any client queries from slipping through the cracks, we have established a follow-up process in our accounting firm. We set reminders to check in with clients on pending matters after a specified period. This proactive approach guarantees that we address any outstanding questions or concerns promptly and never miss an opportunity to provide excellent client service.”

8. Implement a robust client onboarding process.

You can establish a structured onboarding process that includes collecting necessary client information and clearly indicating communication channels and response times from the start. This sets expectations and streamlines future client communication.

![]() Example:

Example:

“As part of our client onboarding process, we have developed a comprehensive questionnaire that collects essential client information upfront. Additionally, we provide our clients with a detailed welcome package that outlines communication channels, response times, and the best methods to reach us. By setting clear expectations from the beginning, we establish a strong foundation for prompt and efficient communication throughout the client relationship.”

Each of the above tactics may have a small impact on overall profitability, but combining multiple tactics can significantly impact your bottom line for the better.

Improve personal income tax client response time & other collaboration aspects with Glasscubes

One of the tactics for reducing client response time was automating routine tasks.

Automation is baked into Glasscubes, a client portal perfectly suited for accounting firms large and small. For example, you can automatically request financial files from your clients instead of spending time sending emails.

You can request documents, ask questions, attach evidence, and question the information received from the other users. Glasscubes is a great platform to work on, and I really enjoy using it.

—Mihaela via Trustpilot

You can also build approval workflows for getting important documents signed off by designees on your and the client’s teams. The system automatically moves documents along after each person indicates their endorsement.

Here are a few other key features accountants love about our client portal:

- File sharing and document management

- File request

- Real-time collaboration

- Task management

- Version control

- Audit trails and access control

- Workspace management

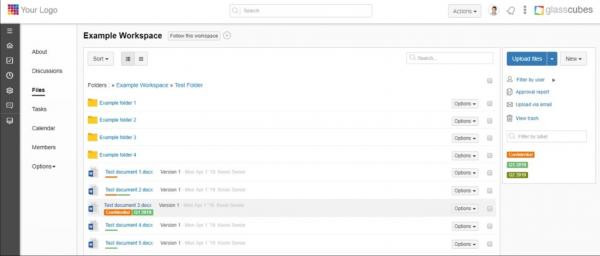

File Sharing And Document Management

File Sharing And Document Management

Easily share and organize financial documents, tax returns, and reports securely in one centralized location.

This eliminates the need for manual tracking and searching through numerous email attachments, ensuring that everyone has access to the latest versions of documents.

File Request

File Request

Avoid the annoyance of emailing clients to collect multiple files (an especially useful feature during tax season or audits!). Whether you need 10 documents or 100, you can collect them all via a single link that navigates to a unique, secure portal where clients can upload the documents you need. Files are checked off as they’re uploaded, so you and clients can easily see progress.

Real-Time Collaboration

Real-Time Collaboration

Communicate and collaborate internally and externally in real time.

This feature eliminates delays and miscommunications associated with email threads.

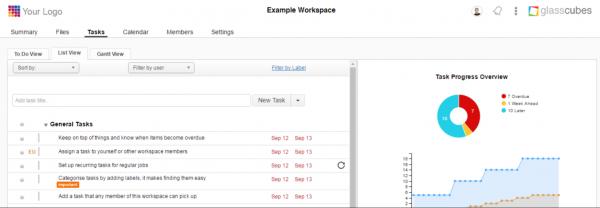

Task Management

Task Management

Create and assign tasks to clients.

Task reminders and notifications make it easy to convey clear expectations and deadlines, which improves accountability and timely completion of deliverables.

Version Control

Version Control

Never again lose track of document versions!

Rest assured that everyone is working on the latest iteration of every document. This mitigates the risks of using outdated or incorrect information.

Audit Trails And Access Control

Audit Trails And Access Control

Automatically record and track all your accounting activities.

Glasscubes provides an audit trail for accountability and compliance purposes. Accountants can control access permissions to determine who can view, edit, or download specific documents.

Workspace Management

Workspace Management

Organize your work with workspaces.

In Glasscubes you can create a workspace for each client and give access to only that client’s team and relevant members of your staff.

Address the concerns of your personal income tax clients in hours instead of days, and see your profits rise quarter over quarter with Glasscubes. Book a free demo today.

“Saving us hours of resource”

“Saving us hours of resource”

“Prior to using Glasscubes, our whole team was involved in contacting our clients multiple times a year to request their records. This was very time-consuming and was not as successful as we would have liked.

We started using Glasscubes this tax year and to date it has saved us around 288 hours of resource, allowing our staff to proceed with actual work. ”

—Sophie M, a manager in the accounting industry, via Capterra