Overview

Auditing software for accountants is indispensable for enhancing efficiency, accuracy, and compliance in auditing processes. By automating repetitive tasks and improving communication among teams, it addresses the current challenges faced by accounting managers. Key features such as real-time reporting, data analytics, and compliance tracking streamline workflows and significantly reduce the risk of human error. This, in turn, leads to higher quality audits and increased client satisfaction. Embracing such technology not only transforms auditing practices but also positions firms for greater success in a competitive landscape.

Introduction

In the rapidly evolving landscape of accounting, the integration of auditing software has emerged as a pivotal solution for firms striving for efficiency and compliance. As organisations confront the complexities of regulatory requirements and the imperative for precise financial reporting, tools like Glasscubes provide a critical advantage by automating tedious tasks, enhancing data accuracy, and fostering seamless communication.

With a focus on the pressing demands of 2025, this article examines the essential features and benefits of auditing software, exploring its transformative impact on accounting practices. From streamlining workflows to facilitating real-time insights, the advantages are unmistakable, underscoring the necessity for firms to adopt these technologies to maintain their competitive edge.

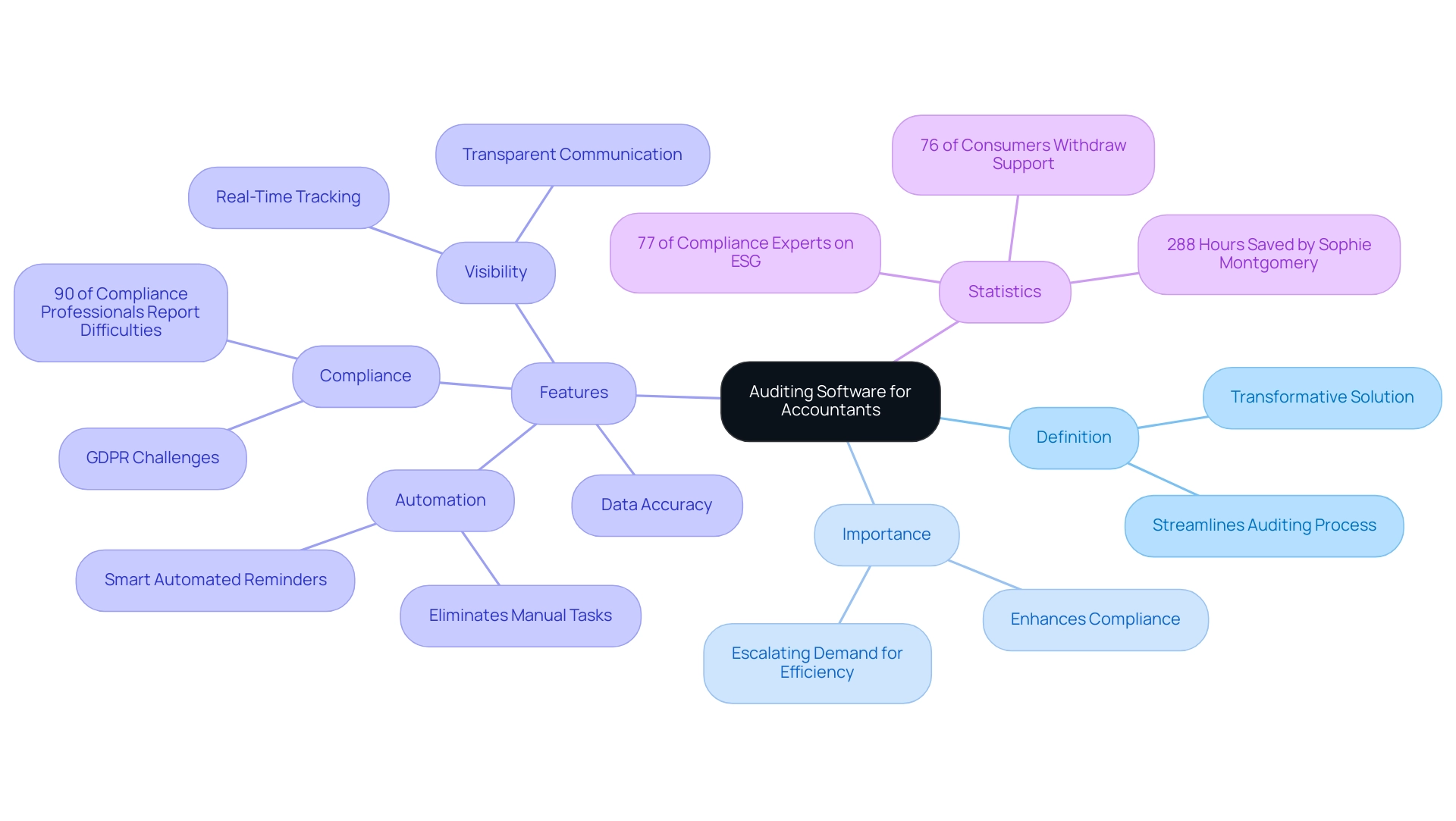

1. Name: Understanding Auditing Software: Definition and Importance

Auditing software for accountants represents a transformative solution, designed to streamline the auditing process by automating repetitive tasks, enhancing data accuracy, and ensuring adherence to regulatory standards. In 2025, the significance of such applications is underscored by the escalating demand for efficiency and reliability in accounting practices. This platform, equipped with a powerful information request tool, optimises audit communication by eliminating the confusion of endless email threads.

Its structured tool approach effectively prevents duplicated requests and misplaced information, making interactions easily accessible and organised. As organisations face mounting pressure to comply with evolving regulations, auditing software for accountants like Glasscubes offers a vital solution to minimise human error and provides real-time insights into audit activities. The platform’s visibility into audit processes empowers both teams and clients to maintain a commanding position through real-time tracking and transparent communication, ultimately making the process less stressful and more efficient.

Notably, 77% of corporate risk and compliance experts emphasise the necessity of staying informed about ESG developments, further highlighting the need for robust assessment tools in today’s landscape. Additionally, with 76% of consumers indicating they would withdraw support from companies that mistreat employees, the implications of compliance extend far beyond mere regulatory adherence. The General Data Protection Regulation (GDPR) continues to pose challenges for firms, with an astounding 90% of compliance professionals reporting difficulties in achieving compliance.

The platform’s features, including smart automated reminders, assist firms in navigating these challenges by replacing manual, time-consuming chases with timely data submissions, ensuring a seamless workflow. Real-world examples, such as the experience of Sophie Montgomery from TaxAssist Accountants, who reported an impressive 288 hours saved in just one tax season, illustrate the tangible benefits of these tools. By utilising auditing software for accountants, detailed reviews can be conducted more efficiently, ultimately enhancing compliance effectiveness and fostering more structured financial practices.

2. Name: Key Features and Functionalities of Auditing Software

Essential auditing software for accountants in 2025 is characterised by several critical features that significantly enhance workflow and outcomes:

- Automation: By minimising manual tasks, the auditing software enables professionals to devote more time to in-depth analysis rather than data entry, thereby increasing overall productivity. With smart automated reminders, it ensures timely data submissions and smooth workflows. In fact, 61% of organisations employ some level of security AI and automation, which correlates with improved efficiency and reduced data breach costs.

- Optimised Communication: Leave behind the confusion of endless email threads. The company provides a structured tool for streamlined information requests, eliminating nuisances like duplicated requests or misplaced information, which enhances user engagement. Additionally, all interactions are neatly archived and easily accessible, ensuring that crucial information is always at hand.

- Data Analytics: Advanced analytics tools empower auditors to examine large datasets efficiently, uncovering trends and identifying anomalies that could indicate issues requiring attention.

- Compliance Tracking: This feature is vital for ensuring that firms adhere to regulatory standards, helping avoid costly penalties and enhancing operational integrity.

- Collaboration Tools: Seamless communication among team members and stakeholders is facilitated, fostering transparency and enhancing the audit process.

- Real-Time Reporting: Instant insights into audit progress and findings are invaluable, enabling prompt decision-making and adjustments as necessary. Visibility into audit processes ensures that both the team and stakeholders are informed, placing them in a commanding position and making the entire experience less stressful and more efficient.

- Effortless Onboarding: Glasscubes ensures a hassle-free setup experience with no training required. During a customised onboarding call, the team sets up the portal according to your workflows, enabling teams to skillfully navigate the client portal quickly.

Together, these features not only enhance the review process but also strengthen its efficiency and effectiveness, aligning with the evolving demands of the accounting profession through the use of auditing software for accountants. As emphasised by Sophie Montgomery from TaxAssist Accountants, the use of such tools can result in substantial time savings, reporting an impressive 288 hours saved in just one tax season. Additionally, the diverse range of services offered in the financial services market emphasises the critical role of auditing tools in ensuring operational integrity and compliance.

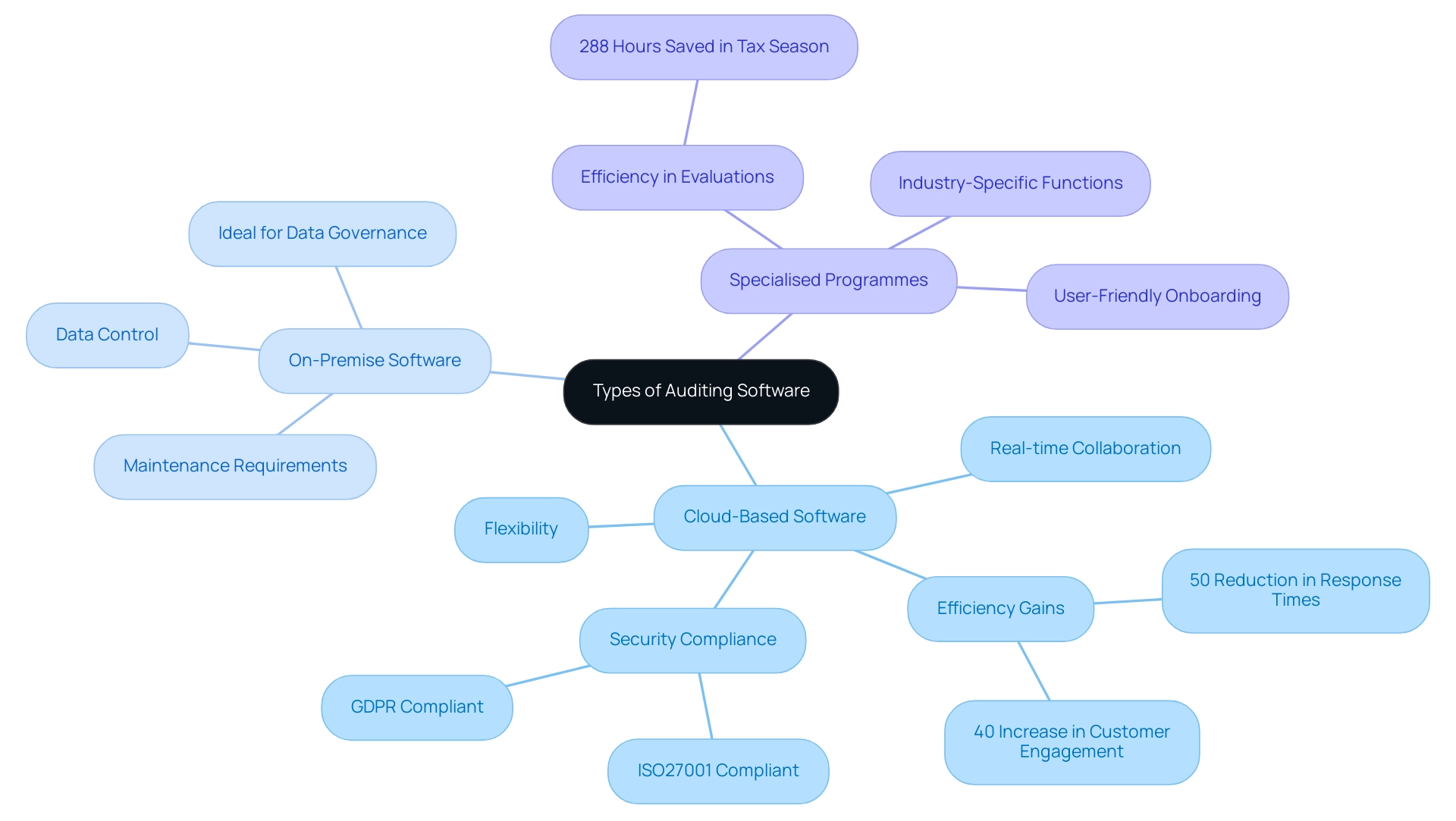

3. Name: Exploring Different Types of Auditing Software

Auditing software is categorised into three primary types, each serving distinct purposes within the accounting landscape:

- Cloud-Based Software: This type offers unparalleled flexibility and accessibility, empowering auditors to conduct their work from virtually any location with internet access. Cloud solutions, particularly platforms like these, are increasingly favoured for their ability to facilitate real-time collaboration and data sharing—an essential feature in today’s fast-paced business environment. Notably, companies utilising this software have reported a remarkable 50% reduction in response times and a 40% increase in customer engagement, underscoring the efficiency advantages these applications provide.

With automated communication and information-gathering tools, the platform enables auditors to engage with clients more effectively, transforming the auditing experience. Moreover, organised communication tools eliminate confusion from numerous email threads, while real-time insights into audit processes keep both teams and clients informed. The company adheres to stringent security standards, being ISO27001 and GDPR compliant, which enhances trust and credibility with clients.

- On-Premise Software: Installed directly on company servers, on-premise solutions offer firms greater control over data security and compliance. However, they require more maintenance and IT resources. This option is ideal for organisations that prioritise stringent data governance and possess the necessary infrastructure to support local installations.

Yet, as more firms pursue efficiency, the shift towards cloud-based solutions like Glasscubes becomes increasingly attractive.

- Specialised Programmes: Designed for specific industries or evaluation types—such as financial assessments, compliance reviews, or internal examinations—specialised programmes address the unique requirements of each evaluation scenario. By focusing on specific functionalities, these tools enhance the efficiency and accuracy of the evaluation process.

For instance, Sophie Montgomery from TaxAssist Accountants reported significant time savings, noting an impressive 288 hours saved in just one tax season by utilising efficient review tools. This platform, with its user-friendly onboarding and dedicated customer success management, establishes itself as an essential resource for accountants, providing auditing software tailored to various specialties. As the evaluation landscape continues to evolve, understanding the benefits of each application type becomes crucial for accountants aiming to enhance their processes and meet client expectations.

The 2025 compliance trends report highlights the importance of staying informed about regulatory changes, emphasising that 61% of compliance experts prioritise this aspect, further illustrating the necessity for flexible evaluation solutions.

4. Name: Cost Considerations: Budgeting for Auditing Software

When budgeting for auditing software for accountants, firms must navigate several key considerations to ensure they select a solution that aligns with both their financial and operational needs.

- Subscription Models: Many leading auditing software solutions operate on a subscription basis, providing various payment options that may involve monthly or annual fees. The monthly account fees for the platform are £120 for the Essential plan, £180 for the Professional plan, and £360 for the Advantage plan, with monthly user licence fees of £18, £22, and £38 respectively. These costs can vary significantly based on the features and services included. Notably, firms utilising this platform benefit from unlimited client engagement features, which have been shown to achieve a 50% reduction in response times, translating to significant efficiency gains and cost savings over time.

- Licensing Fees: Some platforms may have a one-time purchase or licensing fee that can influence initial budgeting decisions. Understanding whether a technological solution requires these upfront costs is crucial for effective financial planning.

- Hidden Costs: It’s imperative to consider additional expenses that may not be immediately apparent, such as costs associated with training staff, ongoing technical support, and future upgrades. These hidden costs can accumulate over time, impacting the overall budget significantly. For example, Sophie Montgomery from TaxAssist Accountants indicated saving an impressive 288 hours in just one tax season through the use of the platform, highlighting the potential for decreased operational expenses via efficient technology implementation. Firms should take a holistic view of these elements to ensure they choose a review solution that not only meets their immediate needs but also remains sustainable in the long term.

- Compliance Considerations: Additionally, budgeting for evaluation tools must take account of compliance costs, as illustrated by the case study on annual review expenses for SOC 2 compliance. This highlights the significance of distributing resources for upholding compliance and ensuring that the selected application meets these criteria.

- Support Packages: The company provides various support packages—Bronze, Silver, and Gold—each offering different levels of service. Comprehending these choices can assist companies in planning for the assistance they might require.

By carefully evaluating these elements, such as the intuitive onboarding and time-saving automation capabilities, accounting firms can make better-informed choices about their investment in evaluation tools, ultimately resulting in improved efficiency and compliance.

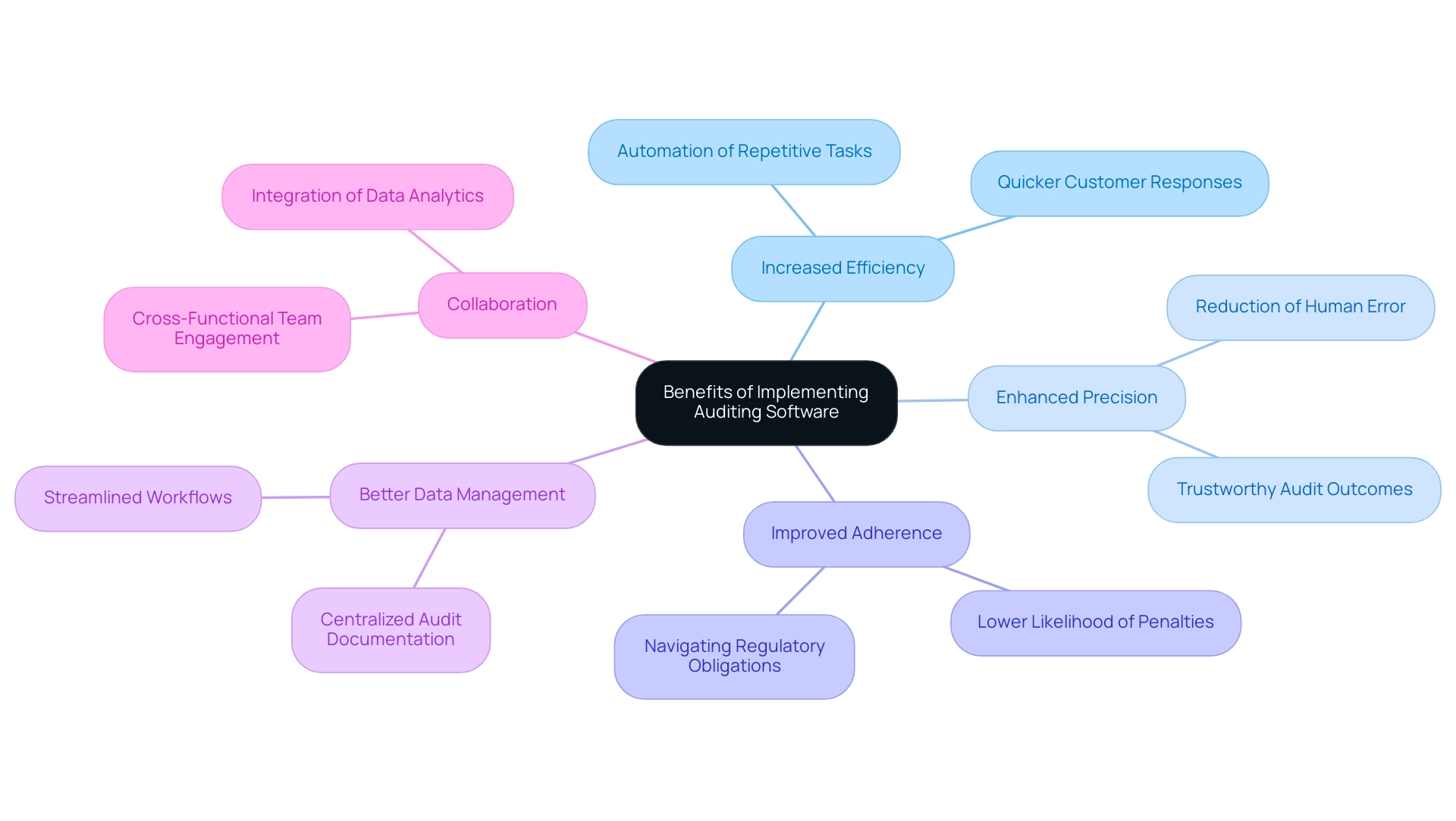

5. Name: Benefits of Implementing Auditing Software in Accounting Practices

Introducing review tools offers numerous benefits that significantly enhance accounting methods. One of the most impactful advantages is increased efficiency; the automation of repetitive tasks enables auditors to complete audits in less time and with fewer resources. Steve, an audit manager at MGI, noted that since adopting Glasscubes, they have experienced quicker responses from customers, largely due to the platform’s transparency and centralised information management.

This is especially essential in today’s fast-paced environment, where 59% of remote programmers report increased productivity—a trend that is reflected in evaluations when utilising advanced tools like assessment applications.

Furthermore, these applications enhance precision by reducing human error, resulting in more trustworthy audit outcomes. This is crucial as firms strive for accuracy in their audit results, ultimately bolstering trust and satisfaction. Enhanced adherence is another key benefit; monitoring tools assist companies in navigating the intricate landscape of regulatory obligations, thereby lowering the likelihood of penalties.

Moreover, superior data management stands out as a notable advantage of adopting such tools. By centralising audit documentation and data, auditors can more easily access and analyse information, leading to streamlined workflows and better-informed decision-making. As highlighted in user feedback, customers value the ability to log into the platform and see precisely what information is pending, which fosters engagement and communication.

This centralisation also facilitates collaboration with cross-functional teams, which is essential for integrating data analytics into audit processes.

Collectively, these advantages contribute to higher quality audits and enhanced satisfaction, underscoring the essential role of auditing software in modern accounting practices. The ease of use and exceptional customer support provided by Glasscubes further distinguishes it from other user portals, ensuring a smooth onboarding experience. The platform supports unlimited client engagement features, such as automated reminders for clients, streamlining the information-gathering process.

As noted by industry expert Petra Martinis, “Generative AI is poised to play a major role in transforming how finance teams in large enterprises operate,” underscoring that the integration of such technology is not just beneficial but necessary for maintaining a competitive edge in the field. By harnessing generative AI, evaluation tools can further streamline processes, enhancing both efficiency and accuracy.

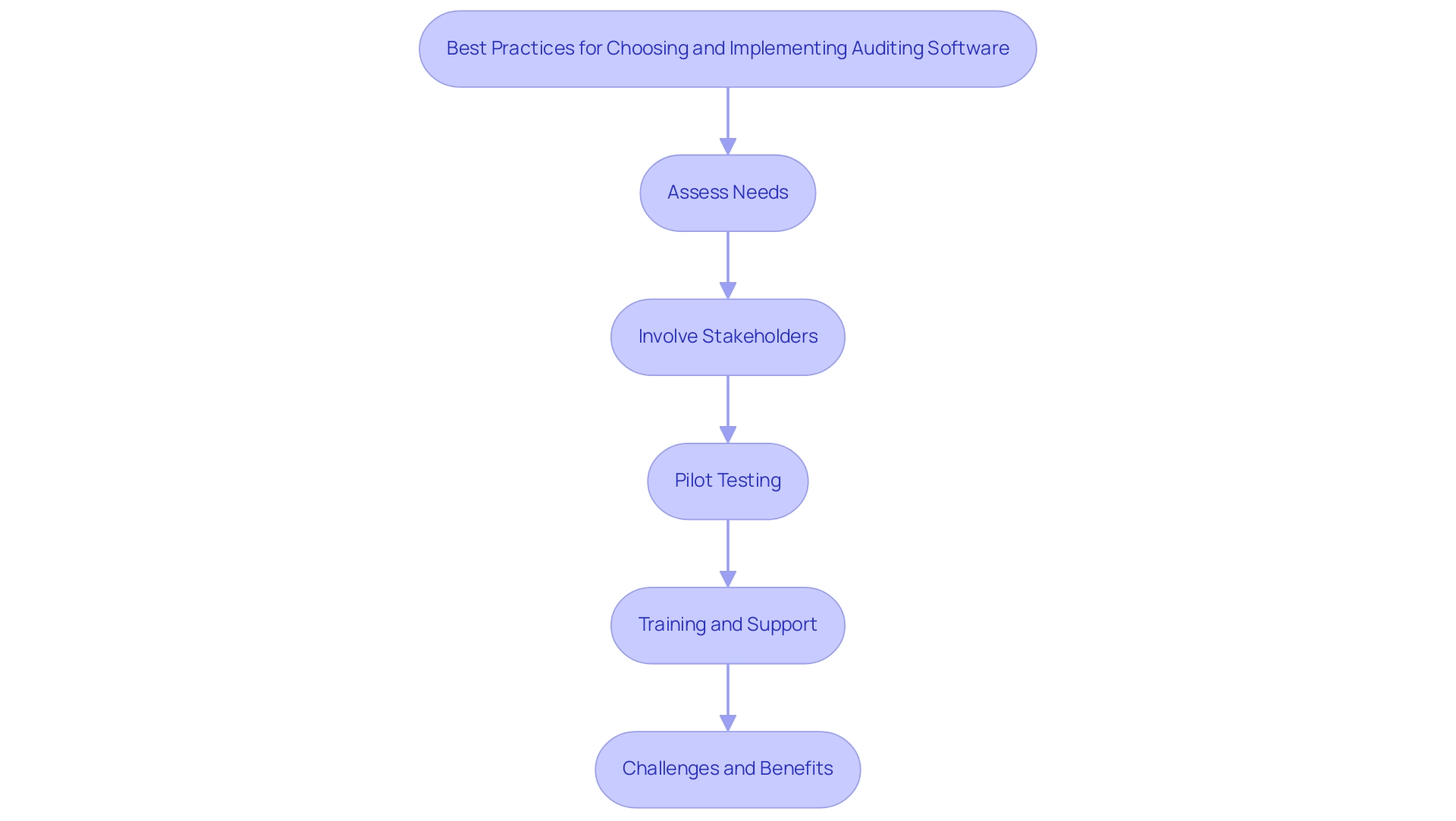

6. Name: Best Practices for Choosing and Implementing Auditing Software

To effectively choose and implement auditing software, firms are encouraged to adopt several best practices:

- Assess Needs: Begin by clearly defining your specific auditing requirements and objectives. Grasping what functionalities are necessary will guide the selection process and ensure that the system aligns with organisational goals.

- Involve Stakeholders: Engaging team members and key stakeholders in the selection process is crucial. Their input ensures that the selected application meets the diverse needs of the entire team, significantly enhancing user adoption rates. Statistics from 2025 indicate that organisations with comprehensive stakeholder involvement achieved a 25% higher satisfaction rate with their solutions.

- Pilot Testing: Before full-scale implementation, conduct a trial run of the application. This pilot testing phase allows you to identify potential issues and gather feedback, ensuring that the transition is as seamless as possible.

- Training and Support: Comprehensive training for all users maximises the system’s capabilities and facilitates a smooth transition. Providing ongoing support post-implementation is equally important, as it helps users navigate challenges and fully utilise the programme’s features.

Furthermore, it is essential to acknowledge the difficulties companies may encounter when adopting evaluation tools. For example, 49% of entities in the public sector indicate a shortage of personnel to achieve cybersecurity goals, which can impede successful application adoption.

Following these best practices can result in successful application adoption, enhancing review processes and boosting overall efficiency. For instance, the platform provides an automated reminder function that enables businesses to send personalised notifications to customers. This feature works by enabling users to set reminders on a simple schedule, with options for unlimited reminders at any frequency or on specific days, ensuring timely communication and boosting response rates.

Firms that have integrated auditing software with their governance functions have reported increased relevance and effectiveness of their audit processes, contributing to organisational objectives. A quote from Appian illustrates the potential efficiency gains: “Appian saved over 100 hours on evidence collection using Hypersyncs, which are data connectors that automatically and continuously pull evidence into the Hyperproof platform.” Furthermore, the unique value proposition of this platform showcases its user-friendly interface, secure file sharing, and improved customer engagement strategies.

The payroll management service provided by Glasscubes simplifies the request and transfer of payroll information, enhancing efficiency and customer satisfaction for accounting firms. By embracing these strategies, accounting firms can significantly enhance their auditing capabilities and client satisfaction through the use of auditing software for accountants.

Conclusion

The integration of auditing software into accounting practices is not merely a trend; it signifies a fundamental shift towards enhanced efficiency, accuracy, and compliance in the industry. Tools like Glasscubes exemplify how automation and optimised communication can significantly streamline workflows, enabling accountants to concentrate on critical analytical tasks rather than repetitive administrative duties. The benefits are evident—reduced response times, enhanced client engagement, and improved data management culminate in a more effective auditing process.

Moreover, the diverse types of auditing software available today cater to distinct organisational needs, whether through cloud-based solutions that offer flexibility or specialised software designed for specific audit types. Understanding these options is essential for firms striving to remain competitive in a landscape characterised by evolving regulatory requirements. The financial implications of adopting such technology are substantial, as firms not only save time but also mitigate risks associated with compliance failures.

Ultimately, the successful implementation of auditing software depends on strategic planning and best practices. By assessing needs, involving stakeholders, and providing comprehensive training, firms can ensure they leverage these tools to their fullest potential. As the accounting landscape continues to evolve, embracing auditing software like Glasscubes will be crucial for firms seeking to enhance operational efficiency and maintain a robust competitive edge in 2025 and beyond. The future of accounting lies in the seamless integration of technology, and those who adapt will undoubtedly reap the rewards.