Overview

This article outlines best practices for gathering personal tax information, emphasizing the necessity of efficient data collection methods to enhance both accuracy and client satisfaction.

Current challenges faced by accounting managers highlight the need for improvement in these areas.

By adopting platforms like Glasscubes, firms can streamline communication, automate reminders, and ultimately save significant time—evidenced by the reported 288 hours saved in a single tax season.

This not only boosts efficiency but also ensures compliance with data protection regulations, reinforcing the platform’s value.

As accounting professionals seek to optimize their processes, embracing such solutions is essential for future success.

Key Highlights:

- Efficient data collection is essential for accurate tax returns and improved client experiences.

- Accountants face challenges such as inconsistent communication, delayed responses, and complexities in information gathering.

- Traditional methods, particularly email, often lead to lost data and repeated requests, complicating workflows.

- Adopting platforms like Glasscubes can save significant time, with reported savings of 288 hours in a single tax season.

- Automated reminders and centralized communication improve response times, with firms experiencing a 40% increase in customer interaction.

- Best practices include establishing clear communication channels, automating reminders, standardizing requests, and educating clients.

- Compliance with data protection laws like GDPR is crucial to protect client information and reduce risks of data breaches.

- Regular training and updates for staff are essential for maintaining compliance and effectively navigating tax information gathering.

Introduction

In the intricate world of personal tax management, the efficiency of information gathering can significantly impact the client experience. Accountants face tight deadlines and complex data requirements, where the stakes are high; delays in obtaining essential information can lead to missed deadlines and increased stress.

By embracing modern technology, such as Glasscubes, firms can transform their approach to streamline communication and enhance the accuracy of tax returns. Automating reminders and centralising client interactions allows accountants to save valuable time while significantly improving client satisfaction.

This article explores the challenges encountered in collecting personal tax information, the pivotal role of technology in overcoming these hurdles, and best practices that can elevate client engagement and compliance in the ever-evolving landscape of personal tax.

The Importance of Efficient Information Gathering in Personal Tax

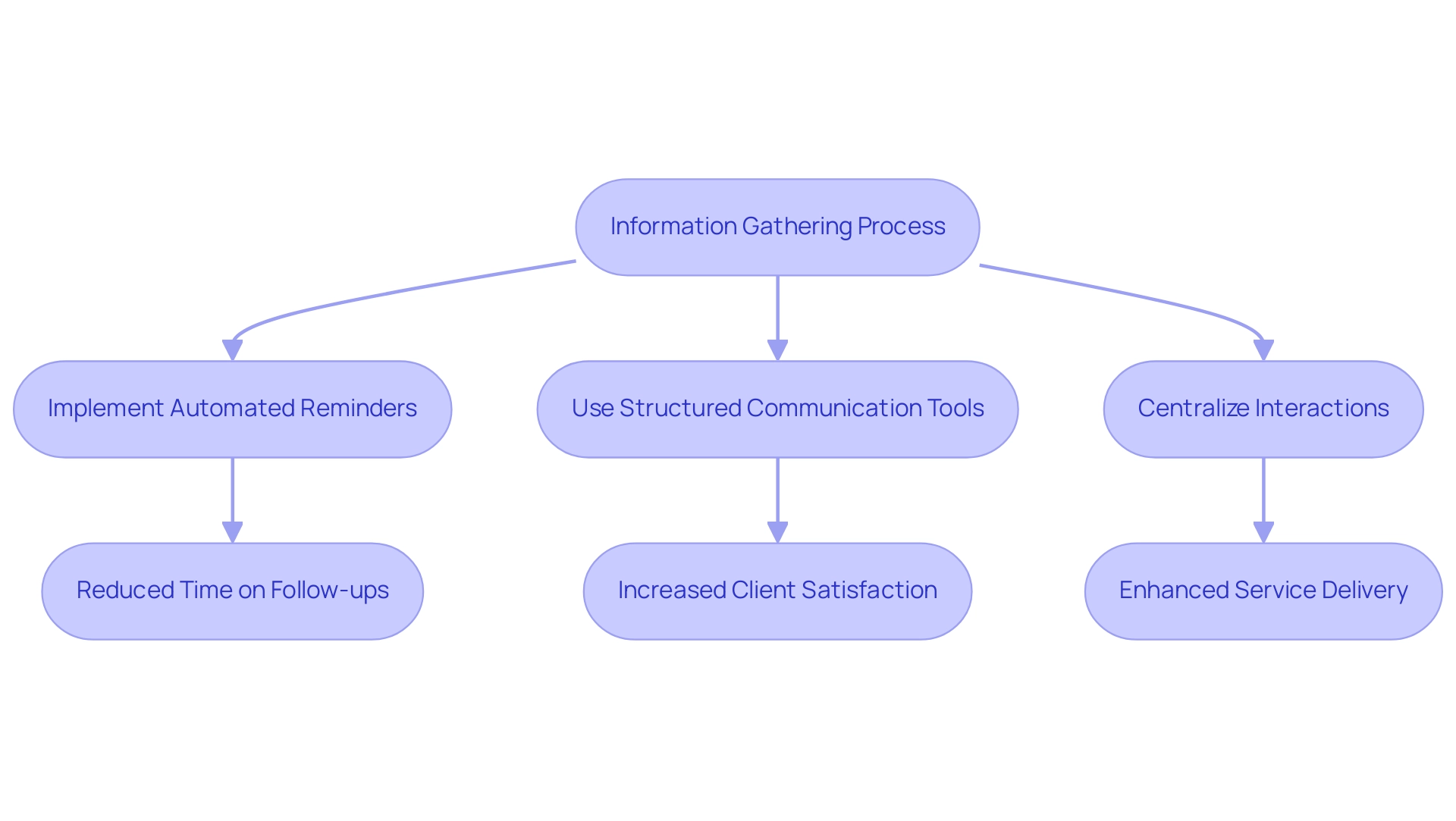

Effective data collection is crucial in the realm of personal tax information gathering, profoundly impacting both the accuracy of tax returns and the overall client experience. Accountants frequently operate under tight deadlines, where delays in obtaining essential information can result in missed deadlines and heightened stress levels. By employing effective systems, such as automated reminders and a structured communication tool, accountants can significantly reduce the time spent on follow-ups while ensuring all interactions are neatly archived and readily accessible.

This strategic approach not only enhances service delivery but also markedly improves customer satisfaction. As noted by Sophie Montgomery from TaxAssist Accountants, the adoption of the platform has led to remarkable time savings, reporting an impressive 288 hours saved in just one tax season. Furthermore, the platform addresses common frustrations associated with missed communications and delayed responses by centralising interactions and providing real-time visibility into audit processes, thereby fostering a more organised workflow.

Its user-friendly interface requires no training, making it accessible for accounting firms. Additionally, the platform is secure, encrypted, and GDPR compliant, providing reassurance for both companies and customers. The implementation of these efficient practices empowers accountants to concentrate on higher-value activities, thereby enhancing the customer experience in 2025.

With a confidence level of 95%, as reported in the ETB publication, the effectiveness of these practices is clearly supported by statistical estimates, affirming the transformative potential of Glasscubes in engaging customers.

Challenges in Collecting Personal Tax Information

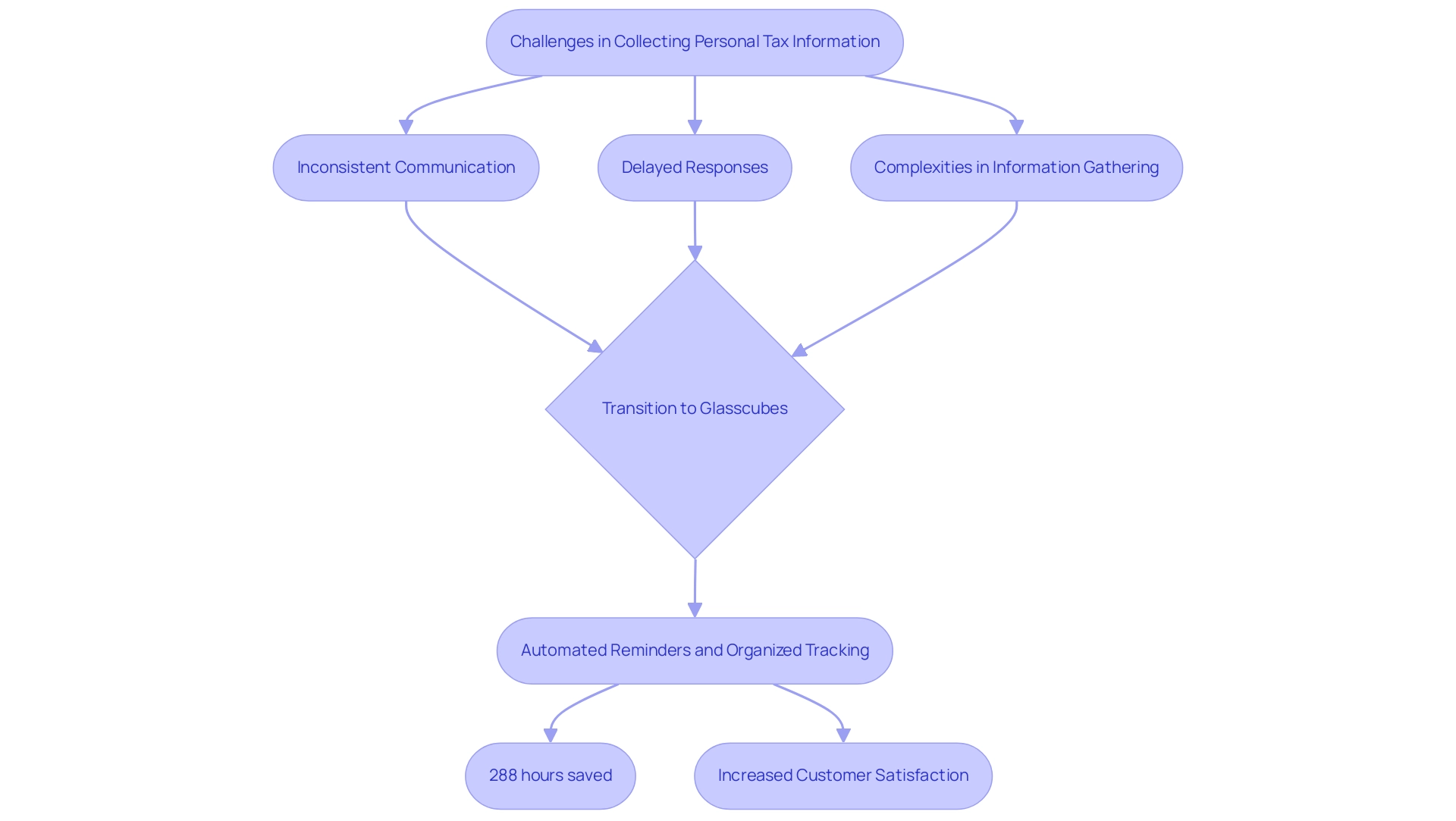

Accountants regularly face a multitude of challenges when it comes to gathering personal tax information from clients. The primary hurdles include:

- Inconsistent communication

- Delayed responses

- Complexities involved in the information-gathering process for tax filings

Traditional communication methods, particularly email, exacerbate these issues, leading to lengthy email chains where crucial details can easily become lost.

This often results in multiple team members requesting the same information, further complicating the workflow. Additionally, clients frequently underestimate the significance of thorough personal tax information gathering, resulting in incomplete submissions that hinder the tax preparation process. Alarmingly, only 11.4% of agent-filed tax returns are completed through HMRC’s website, highlighting the inefficiencies of conventional methods.

Transitioning to Glasscubes allows accountants to significantly streamline their information-gathering processes. The automated reminder feature, for example, enables unlimited reminders tailored for urgency, ensuring that users are prompted to submit necessary documents promptly. This capability directly addresses the frustrations associated with long email threads by providing a clear and organised system for tracking requests and responses.

By recognising and addressing these challenges, firms can enhance efficiency and boost customer satisfaction. As Sophie Montgomery from TaxAssist Accountants noted, companies that adopt more efficient methods report saving an impressive 288 hours in just one tax season. Moreover, insights from the case study titled ‘Uncertainty in Tax Gap Estimates‘ underscore the importance of understanding the reliability of tax gap figures, which is crucial for collecting accurate tax data.

Leveraging Technology to Enhance Information Gathering

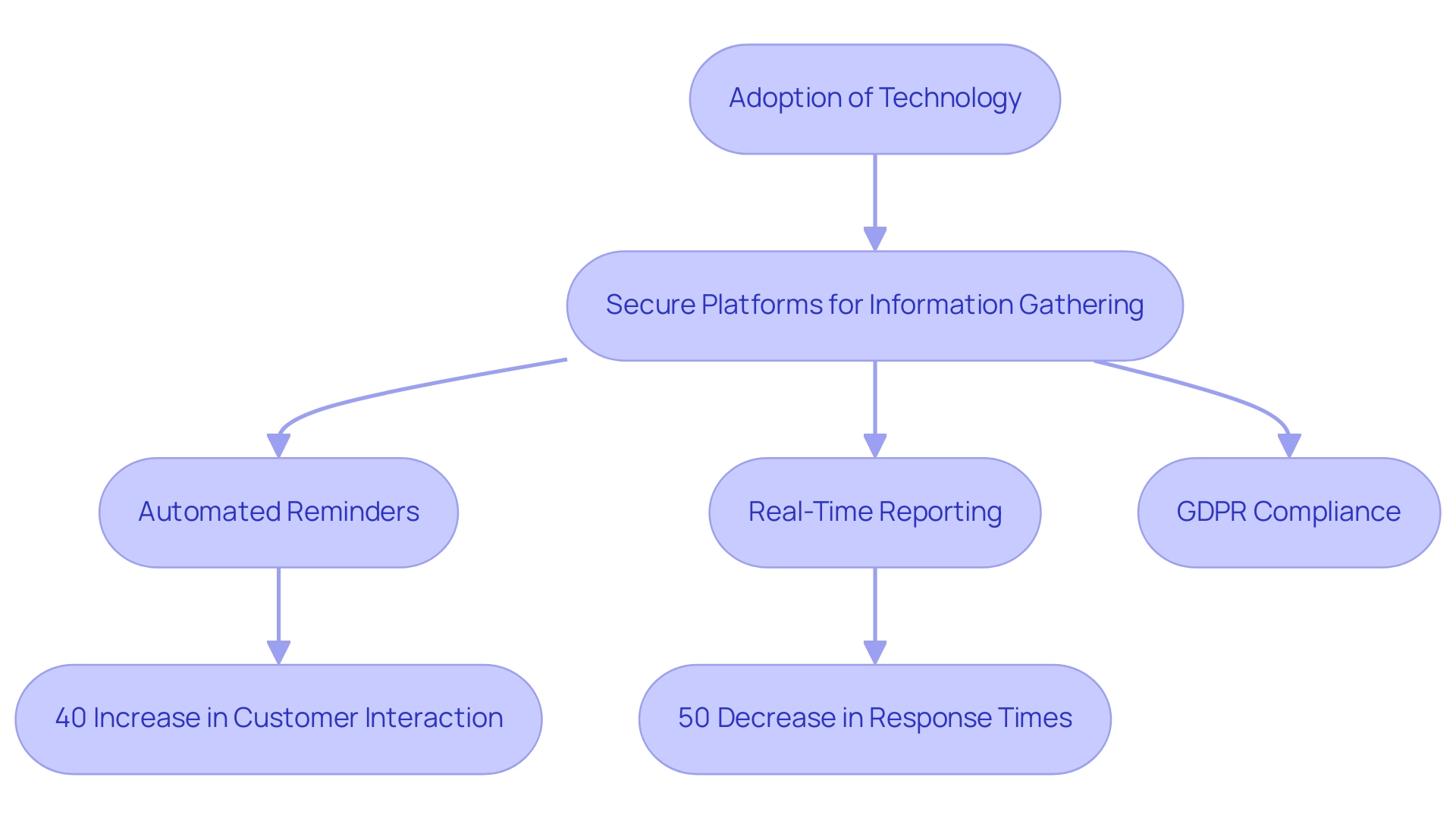

In 2025, leveraging technology has become crucial for enhancing the personal tax information gathering process in tax management. Tools such as secure platforms provide a safe and user-friendly environment that enables accountants to effectively conduct personal tax information gathering and handle customer details. Unlike conventional email communication, which frequently results in lost data and repeated requests, this platform streamlines the process with key features such as automated reminders and real-time reporting.

This guarantees that accountants obtain the essential information quickly, minimising the time devoted to follow-ups and greatly improving customer engagement. Firms using this platform have reported an impressive 40% rise in customer interaction and a 50% decrease in response times. Furthermore, with 84% of respondents agreeing that younger generations have progressive expectations that accounting firms must address, the urgency for adopting modern technologies is clear. As highlighted by ACCA, over 50% of accounting executives foresee that the evolution of automated and intelligent accounting systems will profoundly influence the industry over the next three decades.

By integrating such technologies, accounting firms can transform their tax preparation processes into more efficient and organised operations, meeting the progressive expectations of a new generation of customers. Positive feedback from users, such as audit managers who have observed faster responses from customers and increased transparency, highlights how the platform improves overall efficiency in the accounting sector. Moreover, the platform is secure, encrypted, and GDPR compliant, offering peace of mind for accounting firms and their customers.

Understanding challenges identified in case studies on technology adoption can further assist firms in navigating the transition to advanced systems, ultimately enhancing their service delivery.

Best Practices for Effective Personal Tax Information Gathering

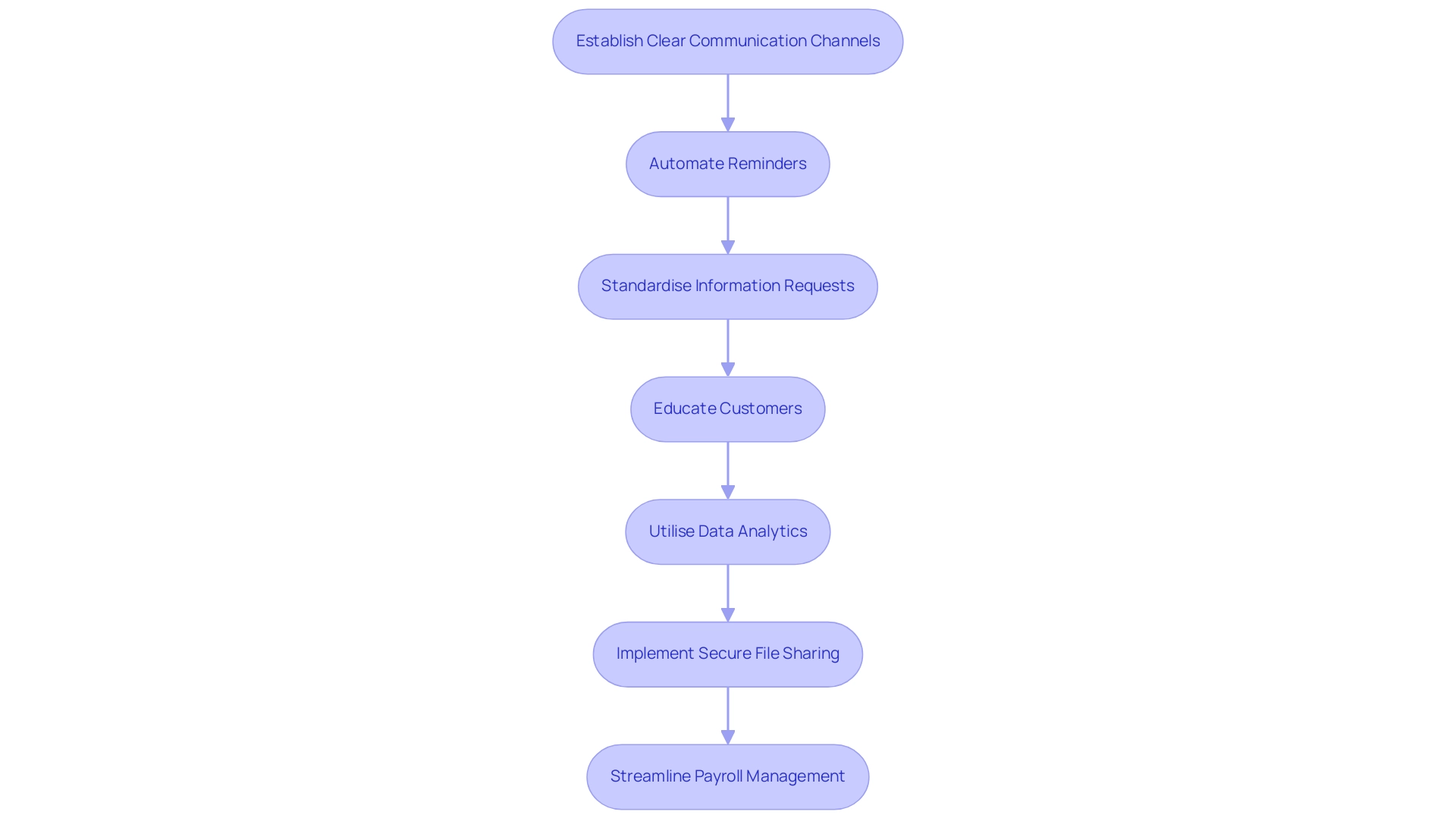

To enhance the efficiency of personal tax information gathering, accountants must adopt the following best practices:

- Establish Clear Communication Channels: Implement a centralised platform that consolidates all customer communications, minimising confusion and ensuring timely responses. This is vital for effective engagement and reduces the risk of missed information.

- Automate Reminders: Utilise automated reminders to prompt users for their submissions, allowing for an unlimited number of reminders tailored to specific schedules and messages. This significantly reduces the need for manual follow-ups, saving time and enhancing customer responsiveness. Firms using Glasscubes have reported a 40% increase in response rates and a 50% reduction in response times.

- Standardise Information Requests: Develop standardised checklists of required documents to streamline the personal tax information gathering process. By providing customers with clear expectations, accountants can enable smoother data collection.

- Educate Customers: Offer customers clear insights into the significance of prompt and precise data submission, enhancing their understanding of their role in the process.

- Utilise Data Analytics: Leverage data analytics tools to monitor submissions and identify trends. This proactive approach enables accountants to address potential issues before they escalate, ensuring a more organised and efficient workflow.

- Implement Secure File Sharing: Use secure file sharing features to safeguard sensitive customer data while enabling effortless access and collaboration. This capability enhances overall workflow and client satisfaction.

- Streamline Payroll Management: Take advantage of the payroll solution to manage payroll information efficiently, reducing administrative burdens and improving accuracy during tax season. As noted by Sophie Montgomery from TaxAssist Accountants, utilising the platform has led to an impressive ‘288 hours saved in just one tax season,’ highlighting the tangible benefits of these best practices. With features such as secure file sharing and customisable reminders, this platform guarantees a more efficient accounting workflow, improving user engagement and satisfaction.

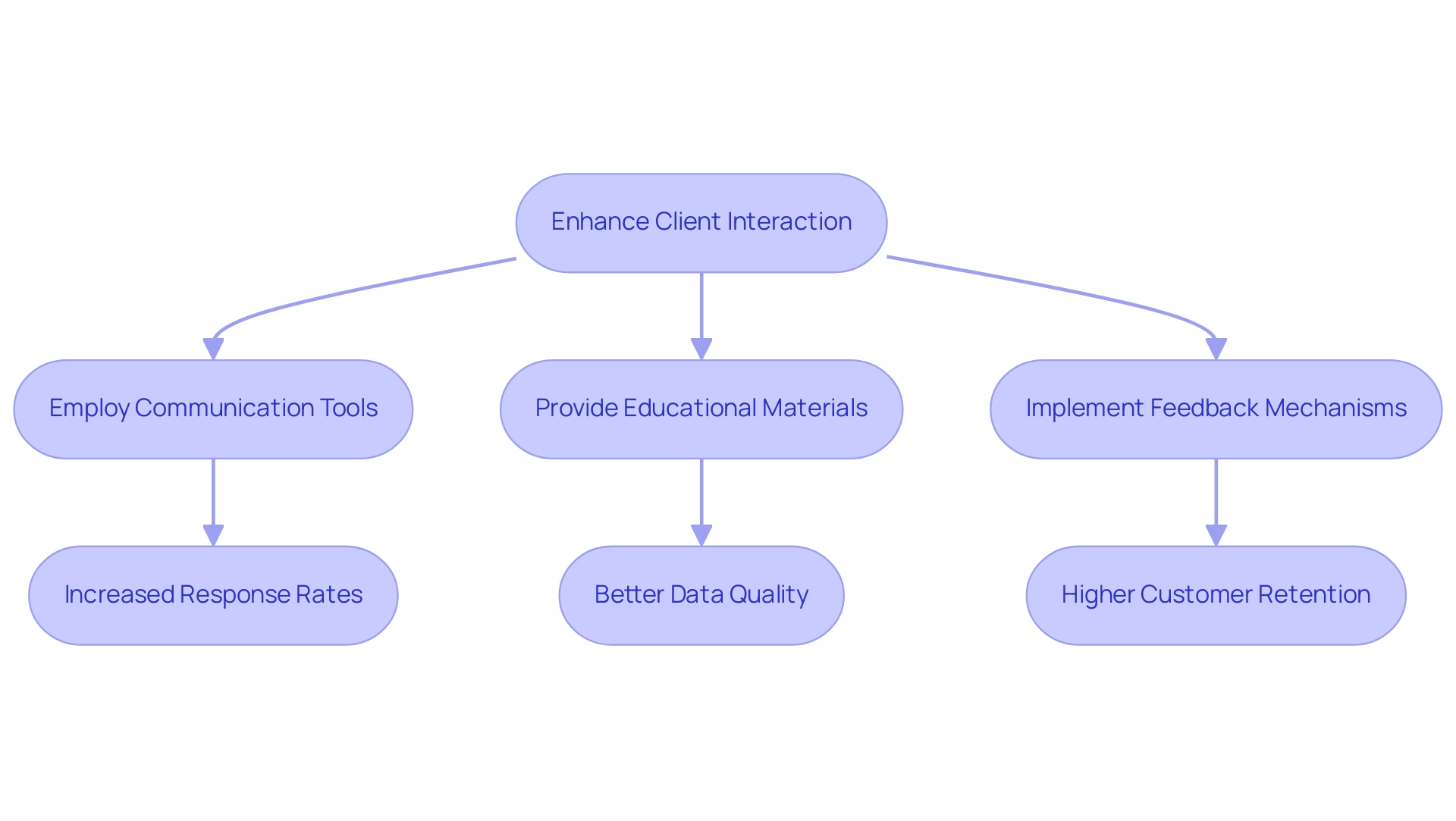

Enhancing Client Engagement for Better Information Collection

Enhancing customer interaction is vital for efficient personal tax information gathering in tax management. With Glasscubes, accountants can elevate their communication strategies by employing tools that streamline data collection and boost response rates. Consistent communication through various channels—such as newsletters, emails, and direct phone calls—ensures that individuals remain informed and actively engaged throughout the process.

By providing educational materials about the tax process, accountants empower customers to supply the necessary details more willingly and accurately. Furthermore, implementing feedback mechanisms—such as surveys—enables accountants to gain deeper insights into client needs and continuously refine their services. The proactive strategies supported by Glasscubes not only cultivate a collaborative environment but also significantly enhance the quality and timeliness of the data collected.

Notably, companies that embrace robust engagement strategies can retain up to 89% of their customers, a stark contrast to the 33% retention rate of those with weaker approaches. This underscores the transformative potential of effective communication in the realm of personal tax information gathering. Moreover, U.K. companies stand to save over £35 billion annually by prioritising customer satisfaction, reinforcing the financial advantages of effective customer engagement.

As demonstrated by firms like Menzies, which have experienced a 40% improvement in response times through the implementation of Glasscubes, enhanced communication can lead to significant time savings—reports indicate 288 hours saved in just one tax season, clearly illustrating this impact. Discover how we revolutionise customer engagements in just 4 minutes! Watch our on-demand demonstration to see how we simplify data collection: Obtain quicker, superior responses from customers.

Avoid workload bottlenecks and delays. Save hundreds of hours of effort.

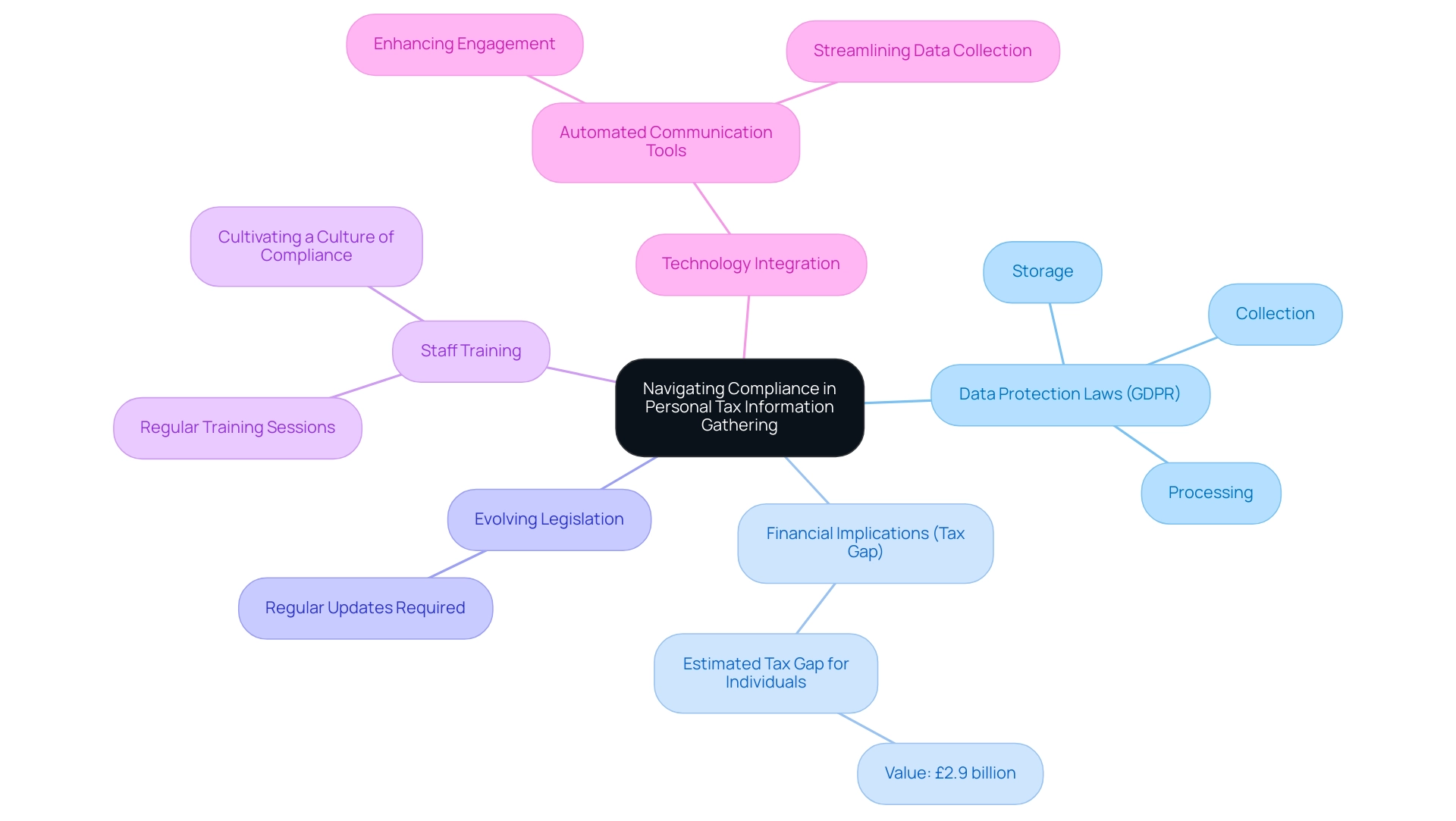

Navigating Compliance in Personal Tax Information Gathering

Ensuring compliance in personal tax information gathering is paramount for accountants aiming to adhere to legal and regulatory standards. The implementation of data protection laws, particularly the General Data Protection Regulation (GDPR), is crucial in governing the collection, storage, and processing of customer information. Establishing secure systems for data management not only protects confidentiality but also reduces the risks associated with potential data breaches.

In fact, the corrected value of the tax gap by customer group for Individuals is estimated at £2.9 billion, underscoring the financial implications of compliance failures. Furthermore, it is essential for accountants to remain informed about evolving tax legislation and compliance requirements to ensure that their methodologies align with current regulations. A recent case study on HMRC’s shift to upstream compliance illustrates a proactive strategy aimed at preventing non-compliance, with upstream compliance activities increasing from 22% to 33% of compliance yield between 2019-20 and 2023-24.

Regular training sessions and updates for staff members are vital in cultivating a culture of compliance within the firm, empowering team members to navigate the complexities of personal tax information gathering effectively. Additionally, utilising automated communication tools from Glasscubes can enhance engagement by streamlining the data collection process and ensuring that privacy policies and cookie settings are effectively communicated to users. This integration not only helps maintain compliance but also fosters trust and transparency in client relationships.

As Claire Aston, TaxWatch Director, states, ‘For all media enquiries about TaxWatch or to be added to our media email list, please contact: Claire Aston, TaxWatch Director.’ This emphasises the importance of seeking expert insights on compliance challenges.

Conclusion

The landscape of personal tax management is evolving, and efficient information gathering has emerged as a critical factor for success. Addressing the common challenges faced by accountants—such as inconsistent communication and delayed responses—enables firms to significantly enhance their operational efficiency. The integration of technology, particularly through tools like Glasscubes, facilitates streamlined processes that not only save time but also elevate the overall client experience. With features like automated reminders and centralised communication, accountants can concentrate on delivering higher-value services while ensuring compliance standards are met.

Insights shared throughout this article underscore the transformative potential of adopting modern solutions in the accounting field. As firms embrace best practices and leverage technology to enhance client engagement, they can navigate the complexities of personal tax information gathering with greater ease. This strategic shift fosters a collaborative environment and leads to substantial time savings, evidenced by reports of hundreds of hours saved in a single tax season.

Ultimately, a proactive approach to client communication and information management is essential for accounting firms aiming to thrive in a competitive market. By prioritising efficiency and compliance, accountants can cultivate stronger relationships with clients, ensuring that they not only meet expectations but exceed them. The future of personal tax management rests with those willing to adapt and innovate, paving the way for a smoother, more effective tax preparation process.